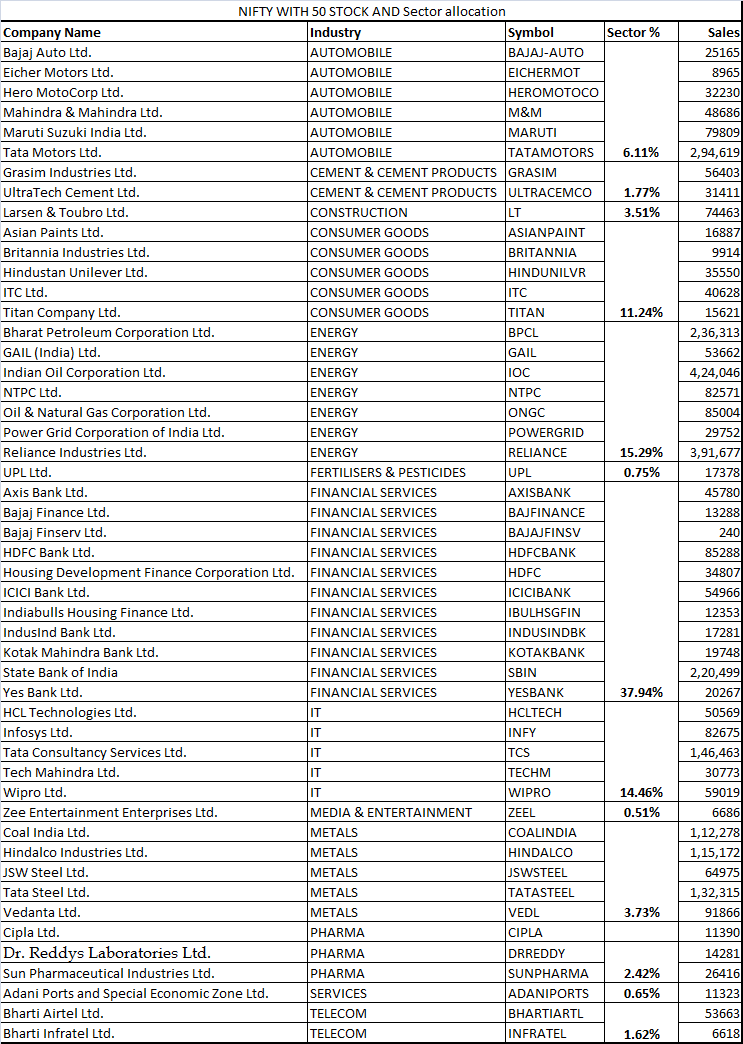

The NIFTY 50 index covers 13 sectors of the Indian economy and offers investment managers exposure to the Indian market in one portfolio. Between 2008 & 2012, the NIFTY 50 index's share of NSE market fell from 65% to 29% due to the rise of sectoral indices like NIFTY Bank, NIFTY IT, NIFTY Pharma, and NIFTY Next 50. WFE, IOM and FIA surveys endorse NSE's leadership position.

NIFTY 50 is the world's most actively traded contract. The NIFTY 50 index has shaped up to be the largest single financial product in India, with an ecosystem consisting of exchange-traded funds (onshore and offshore), and futures and options at NSE and SGX. The Nifty 50 index was launched on 22 April 1996, and is one of the many stock indices of Nifty. NSE Indices had a marketing and licensing agreement with Standard & Poor's for co-branding equity indices until 2013. Nifty 50 is owned and managed by NSE Indices (previously known as India Index Services & Products Limited), which is a wholly owned subsidiary of the NSE Strategic Investment Corporation Limited. It is one of the two main stock indices used in India, the other being the BSE SENSEX. The NIFTY 50 is a benchmark Indian stock market index that represents the weighted average of 50 of the largest Indian companies listed on the National Stock Exchange. On such occasions knowing the fair value of the Nifty 50 stocks enables you to invest in them confidently.Performance of the NIFTY 50 index between 19 But they are available at reasonable prices in a bear market and times of specific temporary setbacks. Investing at very high prices leads to the risk of mediocre returns and steep correction in portfolio worth and eventually exit. The best Nifty 50 stocks are usually expensive and very expensive. This enables them to stay invested and let compounding do its magic.

#Nifty 50 stocks how to#

How to invest in Nifty 50 stocks? The investment approach most suited for Retail investors, is investing in Quality-at-Reasonable-Price. For details read, ‘ Building a Portfolio with Core and Booster Stocks ’

Not all Nifty 50 stocks fit this bill and just selective investment is warranted. This consistency in return will help you stay invested in the equity market. lower corrections and quicker return to fair prices. It is best built of industry leaders and highly efficient companies with low impact from an economic slowdown, competition, or governance issues. Investment in Nifty 50 stocks should be with an aim to build your Core portfolio – a portfolio that is held for the long term and form the backbone of your investments. Company should be allowed to trade in futures and Options segment.A company that has just been listed through an IPO should fulfil all the Nifty inclusion criteria’s for a 3 month period. Listing history: The Company should have a listing history of at least 6 months.Trading frequency: The Company should have traded every day in the last six months.For inclusion in the Nifty, the float adjusted market capitalization of the particular company should be at least 1.5 times the average free-float market capitalization of the present smallest index component. So it excludes locked-in shares including shares held by promoters. It is calculated by multiplying the share price by number of shares readily available for trade. 10 crores.įloat adjusted market capitalization: Free-float market capitalization is a measure of the market cap of a particular company that is available for trading.

For a stock to be included in the NIFTY 50, it should have traded at a market impact cost less than or equal to 0.50% during the last six months and for a trade worth minimum Rs. NSE measures liquidity in terms of Market impact cost, the costs faced when actually trading an index stock. Simply put if you are able to get a large quantity of a stock at the currently quoted price then the stock is liquid.

0 kommentar(er)

0 kommentar(er)