Think of them as what you’re required to pay, even if you sell zero products or services. As production or sales fluctuate, fixed costs remain stable. These expenses can’t be changed in the short-term, so if you’re looking for ways to make your business more profitable quickly, you should look elsewhere.įixed costs will stay relatively the same, whether your company is doing extremely well or enduring hard times. Your company’s total fixed costs will be independent of your production level or sales volume.Īlso known as “indirect costs” or “overhead costs,” fixed costs are the critical expenses that keep your business afloat.

What Are Fixed Costs?įixed costs are those that can’t be changed regardless of your business’s performance. We’ll highlight the differences between fixed costs and variable costs and even give you a few more financial formulas to take your business to the next level. In this guide, we’ll talk about fixed costs and how you can calculate them. For example, you’ll always be responsible for paying expenses like rent, utilities, and licenses. Fixed costs, on the other hand, are more stable, and you often have less control over them. You’ll be able to quickly cut down on these costs to increase profitability. There will be some expenses you’ll have more control over, like variable costs.

Your income statement should serve as a blueprint for finding ways to make your business more profitable. To be a successful small business owner, you must pay close attention to your company’s financial metrics.

#Examples of fixed expenses how to#

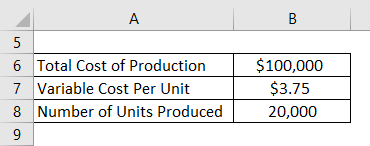

Today we’ll look at how to calculate fixed cost. For example, there are some handy formulas every business owner should know to figure out monthly revenue and expenses. There are many techniques for making your business more profitable.

0 kommentar(er)

0 kommentar(er)